How Orchestration Transforms Fraud Detection Workflows

Unmeshed streamlines fraud detection by orchestrating APIs to reduce manual reviews, helping banks cut costs, eliminate fragile scripts, substantially increase fraud prevention with predictable pricing.

The Growing Cost of Fraud

Fraudsters never stop innovating. From synthetic identities to deepfake onboarding, every year brings new tricks to exploit existing systems. The burden of catching fraud in real time falls directly on businesses and the cost of letting it slip through the cracks can be devastating.

According to Fortune Business Insights the global fraud detection and prevention market was valued at $52.82 billion in 2024 and is projected to exceed $246 billion by 2032. It reflects how serious and expensive the problem has become. Despite this, many organizations are still stuck with manual reviews and disconnected APIs, burning through budgets on processes that software could automate in seconds.

From Chaos to Clarity: How Unmeshed streamlines Fraud Detection Pipelines

Use Case: Onboarding a new customer via digital banking platform

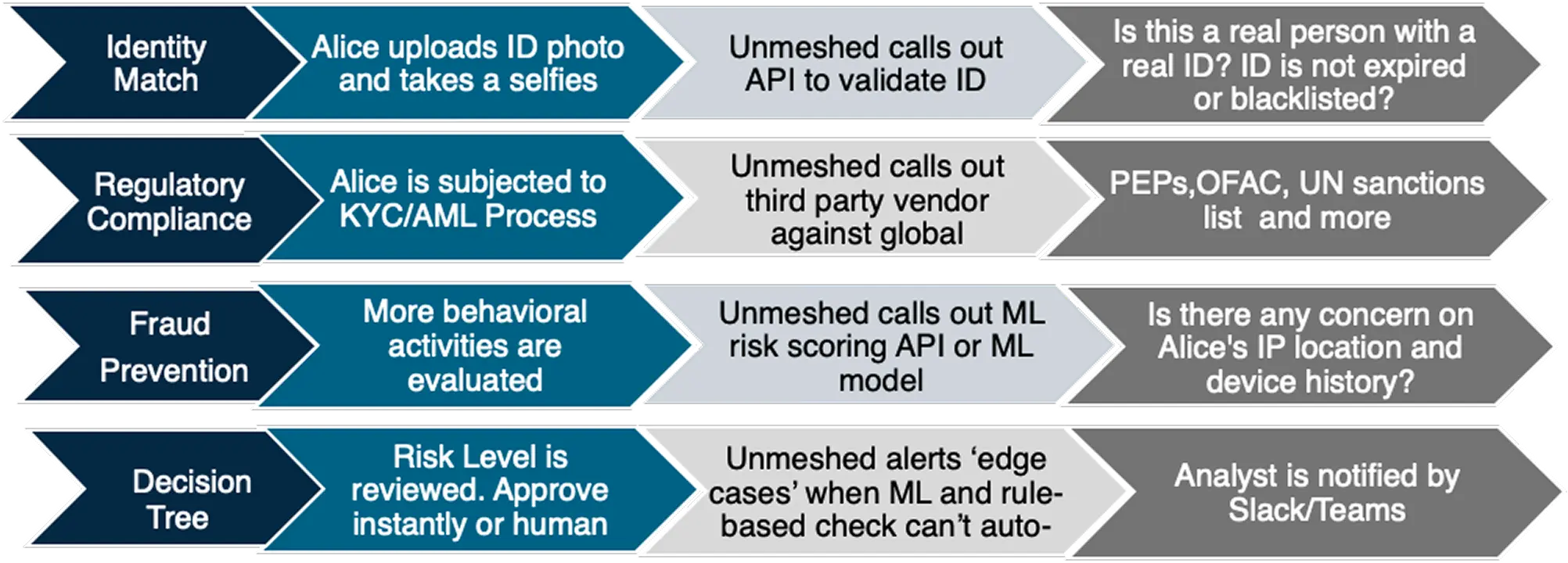

Meet Alice. She wants to open a digital bank account. Here’s how Unmeshed orchestrates the onboarding pipeline to keep Alice and the bank safe:

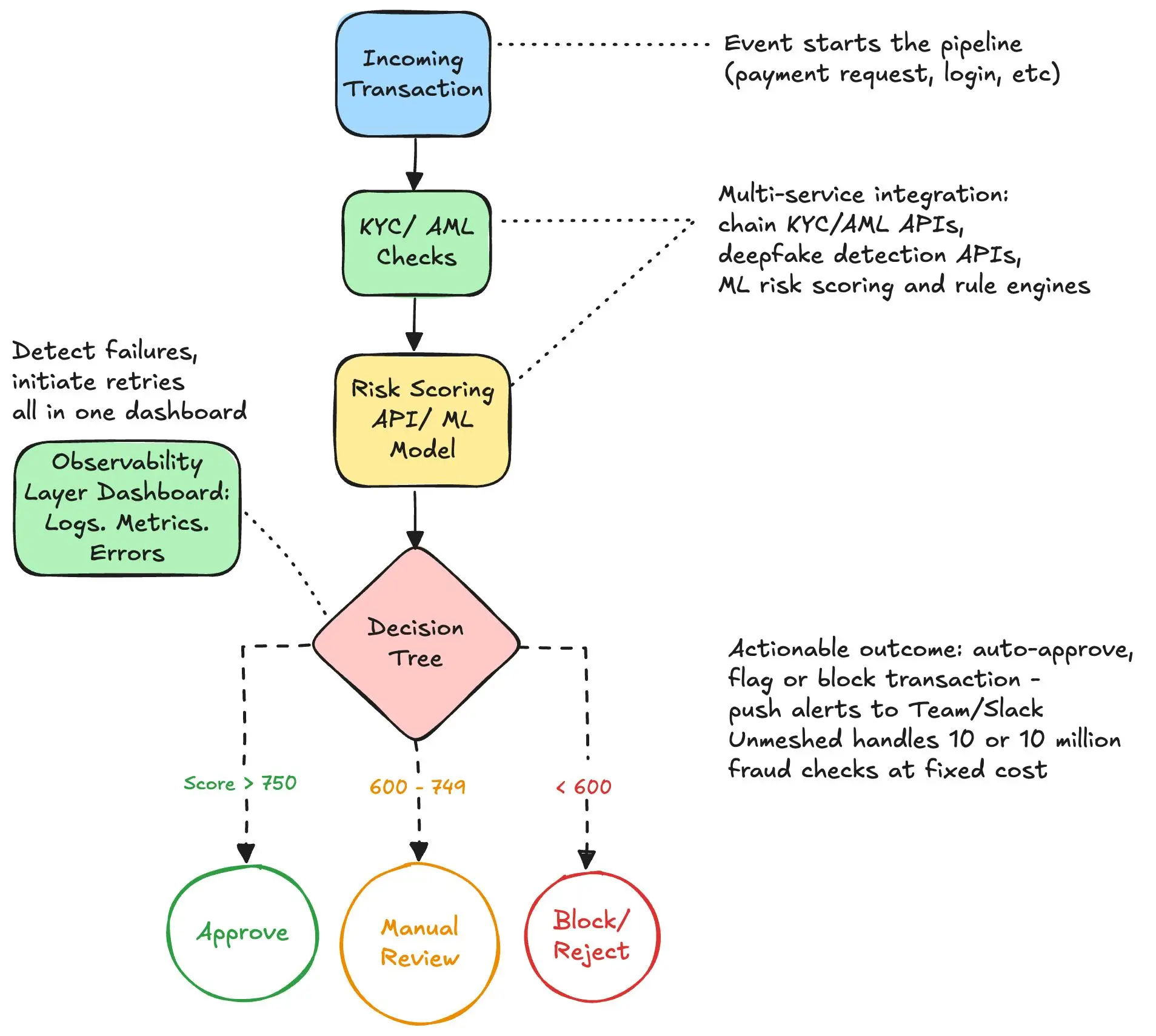

A flow chart demonstrates how the workflow runs seamlessly in Unmeshed:

Workflow in one glance:

name: fraud_detection_pipeline

steps:

- HTTP: # Identity check

id: kyc_check

url: https://kyc.example.com/check

body:

userId: {{ inputs.userId }}

- HTTP: # Risk scoring

id: risk_score

url: https://risk.example.com/score

body:

transactionId: {{ inputs.transactionId }}

kyc: {{ steps.kyc_check.response.body }}

- DECISIONTABLE: # Rules

id: fraud_rules

rules:

- when: { score: "<600" } then: { outcome: "BLOCK" }

- when: { score: "<750" } then: { outcome: "REVIEW" }

- default: { outcome: "APPROVE" }

- SWITCHCASE: # Routing

switch: {{ steps.fraud_rules.outcome }}

cases:

BLOCK:

- HTTP: { url: https://transactions/block }

REVIEW:

- HTTP: { url: https://review-queue/enqueue }

APPROVE:

- HTTP: { url: https://transactions/approve }Unmeshed manages the entire flow of API calls during digital banking onboarding, helping banks cut down on costly developer hours and avoid endless maintenance of fragile scripts, effectively freeing up budget for innovation.

Why Orchestration Saves Money

Instead of throwing more engineers or analysts at the problem, Unmeshed connects all the moving parts into single and automated flow. That shift saves money in three big ways:

1. – Less Manual Review

Most fraud teams spend hours chasing false positives. Incorporating orchestration automates auto-approves on low-risk transaction; for high-risk case it can be blocked instantly. Human task is required only when the rules say, ‘required further review’.

2. – Eliminate fragile scripts to maintain

Without orchestration, developer needs to spend substantial time and resources to fix broken script that stitch every API or data source, silently draining budgets and eating up developer’s time. Unmeshed handles the integrations automatically, freeing developers to focus on core work.

3. – Predictable cost at any scale

While it is not possible to fully eliminate fraudulent activities, Unmeshed handles millions of processes at fixed rate only.

Conclusion: Unmeshed complements Fraud Detection Process using Orchestration Platform

Fraud detection is complex and can’t be stitched together with broken scripts and siloed tools anymore. Unmeshed connects all the APIs and services into one seamless pipeline, so processes flow with little human intervention or brittle scripts.

Banks today spend millions on fraud analysts chasing false positives. With Unmeshed, one mid-market bank automated 95% of checks, cutting review workload by half.”

Ready to see how Unmeshed can simplify your fraud workflows and save money? Book a demo today